Scale Your Impact: Powerful ERP Tools for Microfinance Institutions.

our ERP tools empower microfinance institutions to make a real difference in the lives of individuals and communities around the globe.

Key Features

Your Success, Our Commitment.

In the microfinance landscape, success is not merely about profit margins or bottom lines; it's about transforming lives and lifting people out of poverty.

-

Client Management

The system should allow for comprehensive client management, including the ability to capture and maintain detailed client information such as demographics, loan history, savings accounts, and transaction records.

-

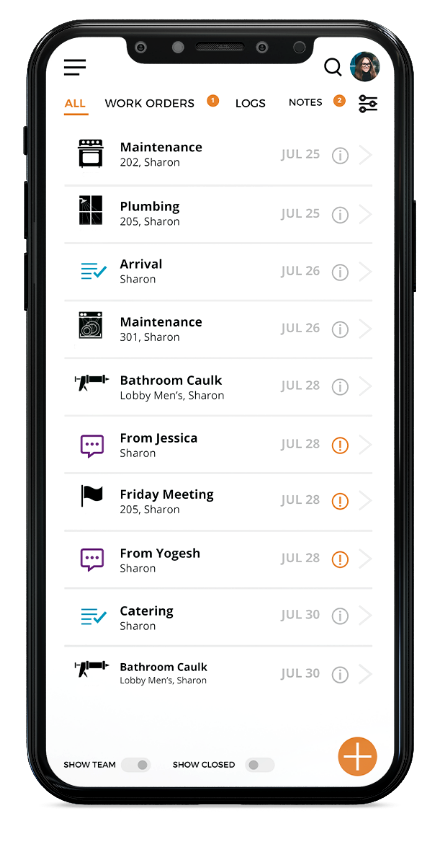

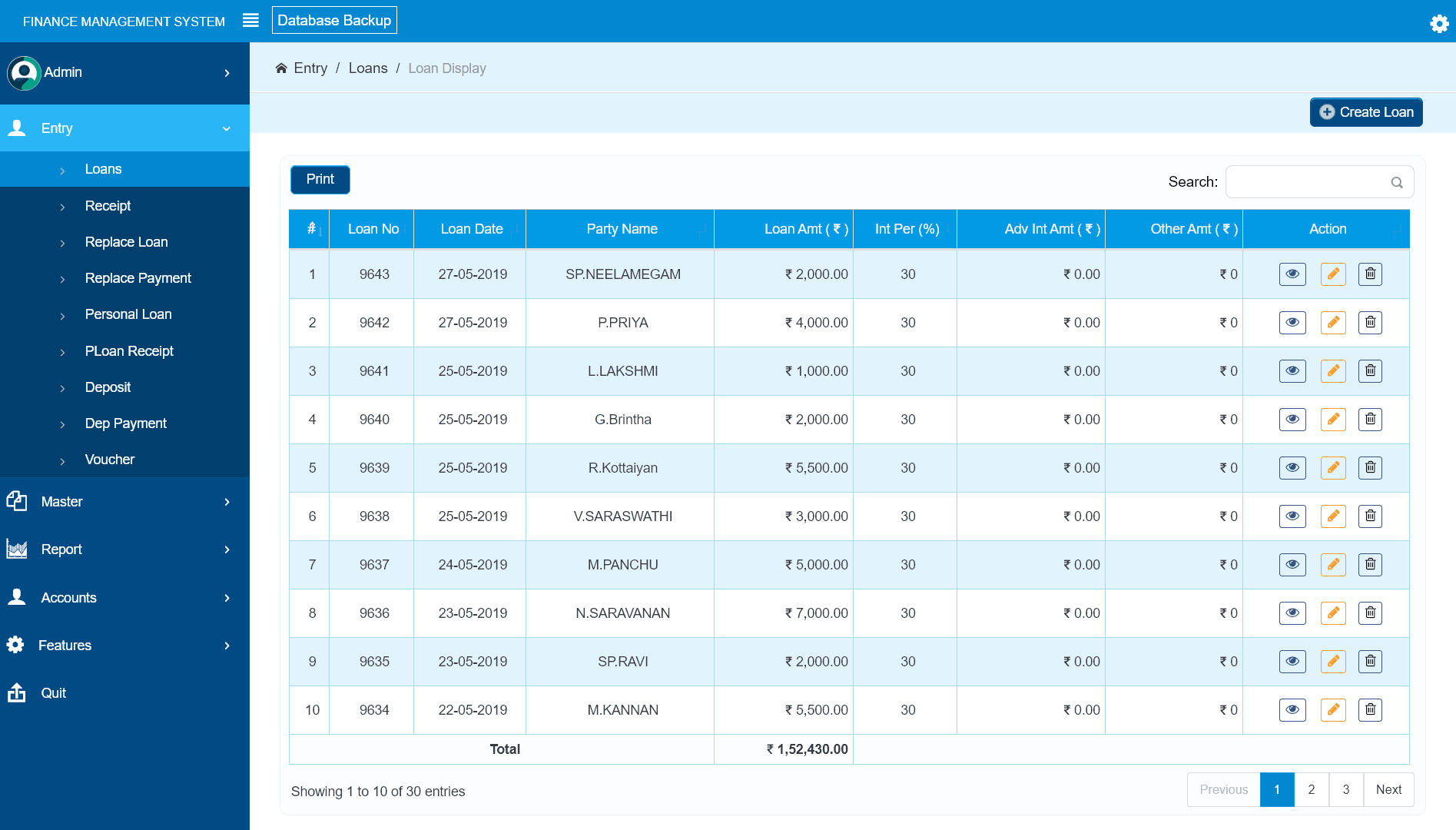

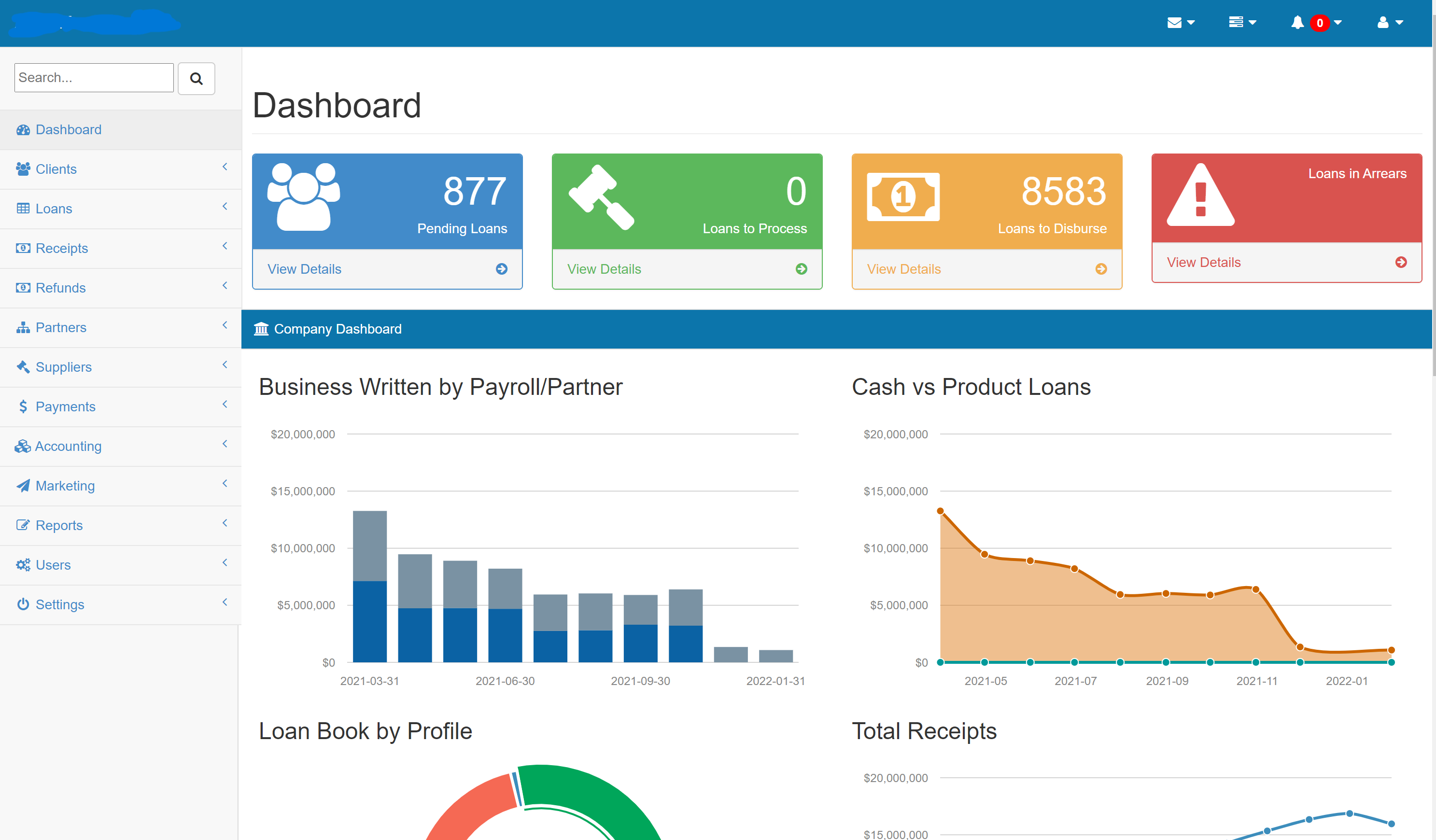

Loan Management

Effective loan management capabilities are essential. This includes features for loan origination, approval workflows, disbursement, repayment scheduling, interest calculation, and penalty assessment.

Advanced Features

Empowering Futures, Enriching Lives.

Our key features set us apart as industry leaders, guiding our mission to serve and inspire communities worldwide.

-

Savings and Deposits Management

The ERP should facilitate the opening and management of savings accounts, including account maintenance, interest calculation, withdrawals, deposits, and transfers.

-

Compliance and Regulatory Reporting

The system should support compliance with relevant regulations and reporting requirements. This includes features for generating regulatory reports, maintaining compliance documentation, and tracking changes in regulatory requirements.

Micro Finance

Software Modules

In the dynamic realm of microfinance, where every transaction has the power to transform lives, our software modules stand as pillars of empowerment and accessibility.

Loan Security Management:

The Loan Security Management module is crucial for managing the collateral or security provided by borrowers against their loans. It tracks and records the details of the security pledged, such as property, assets, or guarantors.Branch Management:

In a Microfinance ERP system, the Branch Management Module serves as the backbone for organizing and managing the institution's hierarchical structure, including divisions, regions, and branch offices.Loan Disbursement:

The Loan Disbursement module facilitates the process of releasing funds to borrowers upon loan approval. It generates the necessary documentation for loan disbursement, including loan agreements, promissory notes, and disbursement schedules.Insurance Management:

The Insurance Management module handles the administration of insurance policies and claims for clients of the microfinance institution. It manages the documentation related to insurance coverage, premium payments, and claim processing.Fund Management for Head Office:

The Fund Management module for the Head Office oversees the receipt, allocation, and transfer of funds within the microfinance institution (MFI).Loan Recovery:

The Loan Recovery module focuses on the collection of loan repayments from borrowers to minimize delinquency and mitigate credit risk. It tracks the repayment status of each loan, generates collection schedules, and monitors overdue payments.WHY

Should You Choose Us

Our Microfinance ERP is a decision rooted in several compelling reasons that directly address the unique needs and aspirations of microfinance institutions (MFIs).

-

Tailored to Microfinance Needs

Our ERP solution is specifically designed to meet the complex and diverse needs of microfinance institutions. From client management to loan processing, each feature is meticulously crafted to streamline operations and drive growth within the microfinance sector.

-

Comprehensive Functionality

Our Microfinance ERP offers a comprehensive suite of modules covering all aspects of microfinance operations, including client management, loan processing, fund management, risk assessment, and financial reporting.

-

Dedicated Support and Training

Our team of experts is committed to providing exceptional support and training to help you maximize the value of our Microfinance ERP.

-

Robust Security and Compliance

We prioritize the security and integrity of your data, implementing robust security measures and compliance protocols to safeguard sensitive information and ensure regulatory compliance.

Integration

Collaborated with premier software Companies

Partnering with top-tier IT firms, we're amplifying innovation and delivering unparalleled solutions.

-

BDFI

-

EKO

-

RazorPay

-

CashFree

-

PayPal

-

WhatsApp Business

-

BankOpen

-

paySprint

-

FingPay

-

Fino

-

CcAvenue

-

BillDesk(Bharat Pay)